Join ASA's Premier ENERGY VALUATION Event! ASA Houston's 16th Annual Award-Winning 2026 ENERGY VALUATION CONFERENCE will be held on Thursday May 14, 2026 with In Person attendees at THE BRIAR CLUB, 2603 Timmons Lane, Houston, Texas 77027 or Virtually via convenient LIVE WEBCAST.

The ASA ENERGY VALUATION CONFERENCE (EVC) is unique in that it is the only MULTI DISCIPLINARY conference with a focus on leading edge VALUATION TECHNIQUES applicable to ALL SECTORS of the ENERGY INDUSTRY.

2026 EVC brings together pre-eminent energy valuation professionals and industry thought leaders presenting timely educational valuation topics, with a focus on valuation impacts in the transition of power generation from fossil fuel to non-carbon, renewables, sustainable energy, and IRS tax & governance issues.

Adam Peters, CEO, Group Executive Committee

Adam Peters, CEO, Group Executive Committee

Air Liquide North America

"Topic Title TBA"

Brian Baumler, CPA, Partner - Energy Practice Leader, SEC, Audit Director

Brian Baumler, CPA, Partner - Energy Practice Leader, SEC, Audit Director

Withum

PANEL: "Topic TBA"

Sandeep Sayal, Vice President, Industry & Market Analytics Consulting

Sandeep Sayal, Vice President, Industry & Market Analytics Consulting

Turner, Mason & Company

"Valuation Conundrums in the Downstream (Refining) and Midstream (Marketing) Sectors": Sandeep is responsible for petroleum markets and downstream analytics and provides thought leadership that contributed to the firm's content development in the "New Energies" space. He also assists clients with strategic business analysis and acquisition/project development and provides supply and trading support to the midstream and downstream industries.

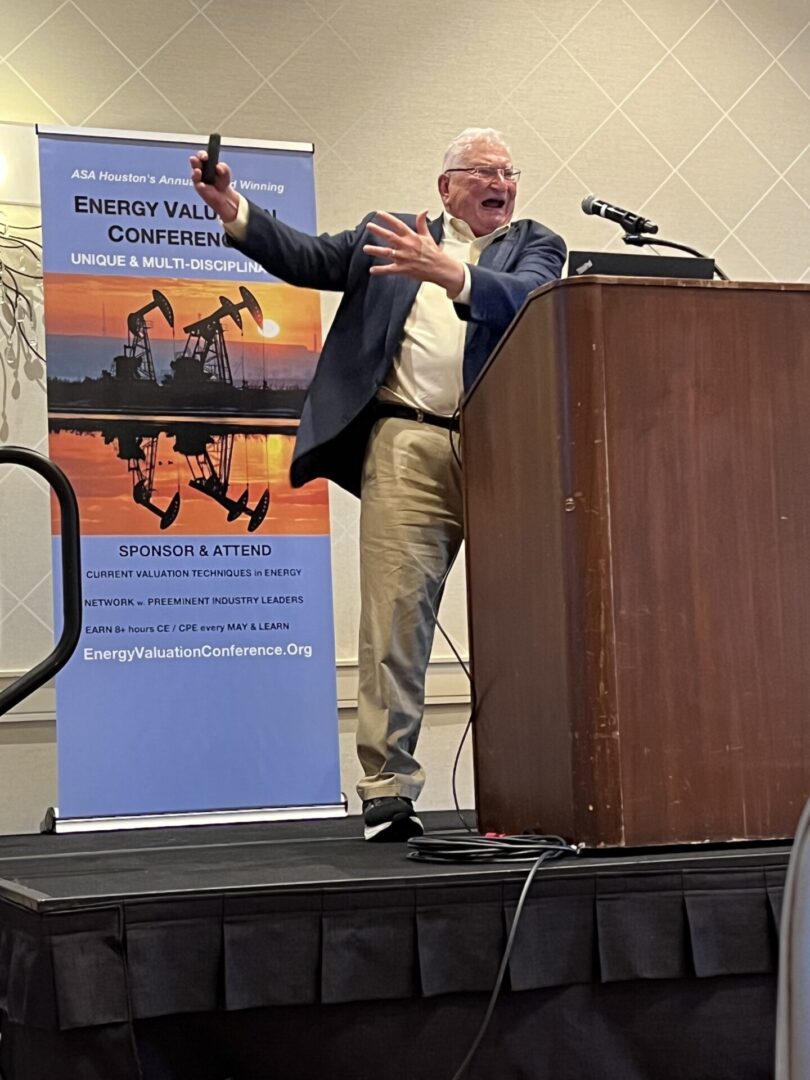

Ed Hirs, Energy Fellow

Ed Hirs, Energy Fellow

University of Houston, Lecturer; Hillhouse Resources, LLC, Managing Director

"Macro-Overview of Energy Markets & Current Events": Ed Hirs is a renown energy economist and lecturer at the University of Houston and current managing director of Hillhouse Resources, LLC, an independent E&P company. He has authored and co-authored published opinion pieces on energy markets and corporate governance, and serves as KHOU-11 Energy Expert.

Marina Kagan, Principal, Financial Analytics and Derivatives Group

Marina Kagan, Principal, Financial Analytics and Derivatives Group

PwC

"Data Center Power Purchase Agreements and other Complex Securities - in connection with AI data center buildout and associated power generation requirements". Marina assists clients with valuation of complex securities for financial and tax reporting, risk management, and transaction structuring purposes. Her work spans energy, commodity, fixed income and equity derivatives, earnouts, and stock-based compensation, with a focus on valuation of energy and technology industries.

Dylan Stephen Siebenaler, Vice President

RBC Capital Markets, LLC

"UpStream Capital Markets": Dylan is a registered representative with RBC in Houston. He is a registered representative with a Series 63 license, and holds product licenses of Series 79TO and SIE.

Energy Topic TBA

Big 4 Firm

"P&U or OFS Valuation Focus" - in progress

Energy Topic TBA

Big 4 Firm

"Midstream Valuation Focus" - in progress

Join as a Sponsor Today!

EXCEPTIONAL OUTREACH: Your Logo included in emails to 6,000 professionals.

Your LOGO & RECOGNITION in:

- EVC Online Brochure.

- Sponsor Power Point Slide Show that scrolls between speakers.

- EVC Website.

- FREE REGISTRATIONS.

What will attendees learn?

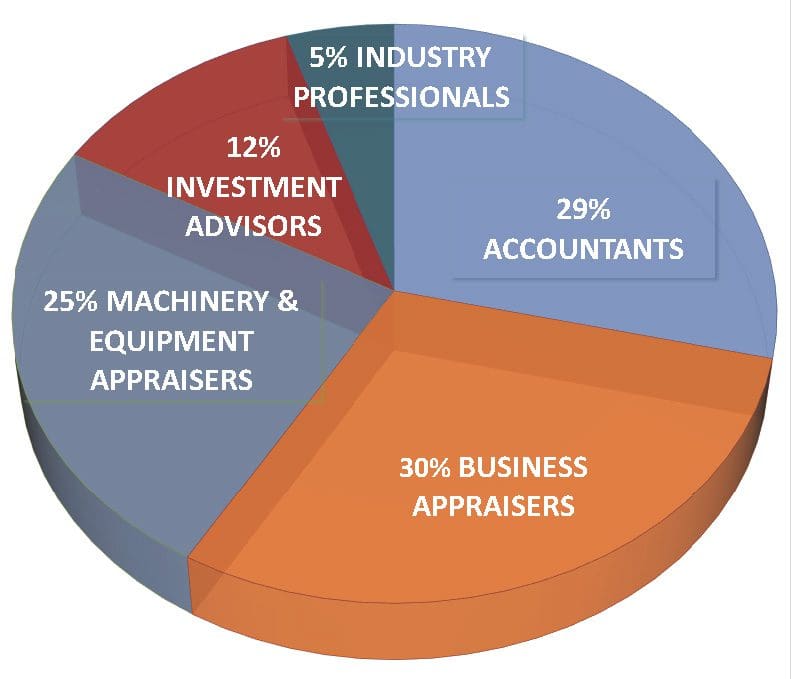

Course Description: This broad-ranging conference facilitates opportunities to interact with key players from various segments of the value chain: downstream, midstream, upstream, and emerging trends in the growing renewables sector. EVC is unique in that it is the only multi-disciplinary conference with a focus on valuation techniques in all sectors of the energy industry. Networking and cross-referral opportunities abound when appraisers, accountants, investment professionals and industry leaders interact.

Why Attend?

Do You Have Clients in the Energy Industry?

- "I will say that it was just as top-notch as it gets. The content was superb and the smooth tech operations really made it one of the best virtual events I've attended yet. Your speakers and sessions were, truly, spectacular."

Learn About the Outlook of the Energy Industry in the Transition to Non-Carbon and Renewables.

- "I thoroughly enjoyed the virtual conference - found it to be very informative and right on point given our current social and economic environment. The speakers were excellent and I look forward to attending next year's conference - virtual or in-person."

Best Networking & Forum to Make Connections.

- "Outstanding reception where industry & appraisers could mingle, network and talk about future business. Energy Valuations are big money, and if I can gain one new appraisal, it will more than pay for my trip." International EVC Sponsor

Speakers are an Excellent & Well-Rounded Mix.

- "I liked the way the speakers expressed divergent opinions vs the previous speakers, and were bold enough to make predictions." EVC Sponsor

- Featured speakers were remarkable leaders from all sectors of the energy industry demonstrating a variety of perspectives in all disciplines: Business Valuation, Machinery & Technical Specialties, Appraisal Review & Management, Real Property, among other."

- "Great program! Getting Karl Bartholomew and the high-powered Commissioner Craddick was a real coup. The diversity of your speakers topically was very impressive. Looking forward to the next one."

What makes energy valuation so important to appraisers?

This dynamic and cyclical industry affects all cities around the world. Even if your client isn't an energy company, energy can still play a vital role in its performance, cost structure and profitability.

What will attendees take away?

Learning Objectives: A better understanding of the current economic and geopolitical conditions of the industry, and learn perspectives on the challenges in energy valuations as the industry turns toward renewables, and how this impacts each sector. EVC is a very holistic and well-rounded conference that attendees enjoy and learn from - not just appraisers. Our goal is to expand our outreach to include those in related professional groups and industry associates.

Featured speakers represent all sectors of the energy industry offering new perspectives on business valuations, machinery & technical specialties appraisals, accounting developments, appraisal review & management, mineral appraisals, real property, financial analysis, and more. Learn how this dynamic and cyclical industry affects businesses world-wide and how it plays a vital role in the performance, cost structure and profitability of your clients. Attendees will gain a better understanding of the current economic and geopolitical conditions of the industry, and learn perspectives on challenges in energy valuations, including which sectors are rebounding.

Sponsor Chair:

Vice Chair:

Event Chair:

Laurie Leigh White

Carol Akers Klug

Tim Stulhreyer

HOUSTON 2026 ENERGY VALUATION CONFERENCE

Thursday May 14, 2026.

Hybrid Format:

2026 EVC registrants may attend either IN PERSON ONLY at THE BRIAR CLUB, 2603 Timmons Lane, Houston, Texas 77027 or ONLINE ONLY by LIVE WEBCAST from 8 am CDT to 6 pm CDT on May 14, 2026. "In person" attendees will not receive online viewing. If you inadvertently signed up for "online" but intended to attend "in person" please let us know as soon as possible. (EVC pays The Briar Club by the headcount as measured by the plate, and we must confirm attendance headcount in advance.)

- IN PERSON attendees may network at our 7 am CDT Breakfast Bar, Fajita Lunch Buffet and Texas Appetizers & Cocktail Social from 6 pm CDT to 7 pm CDT. Park FREE on the 3rd floor of the garage across the street from The Briar Club, walk across the SkyBridge to enter on the conference level.

IN PERSON ONLY and ONLINE ONLY tickets may be purchased below on the EVC webpage.

Education Credits: Up to 8 Hours CPE / CE

The American Society of Appraisers is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. CPE credits approved by NASBA will be provided for both Group-Live "In Person" and for Group Internet Based "Online" CPE delivery. State boards of accountancy have the final authority on the acceptance of individual courses for CPE credit. For more information on eligibility by state, please consult NASBA's website or your state board of accountancy. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.learningmarket.org

Cost:

Registration

ASA Member - 8 CPE/CE hours

Non-Members - 8 CPE/CE hours

Early Bird Rates thru March 31

$300

$325

Regular Rates from April 1

$350

$375

Terms:

- Refund Policy: Non-refundable after March 31. Before March 31 - refundable less $20 transaction fee.

- Substitution of registrants and/or change in format (from "IN PERSON ONLY" to "ONLINE ONLY" or vice versa) is allowed through March 31 by emailing caklug@swbell.net to make the change. Please attend EITHER "in person only" OR "online only" to facilitate registration. [EVC must confirm in person attendance in advance, as EVC pays The Briar Club by the plate]. "In Person" attendees will NOT receive a link to attend online.

- Last day to register is two days before the conference.

- Program Knowledge Level is Intermediate, Advanced, Overview and Fundamental.

- Technical fields of study may include accounting, artificial intelligence, digital transformation, legal & tax issues, data analysis, ESG, forensic accounting, fraud, economics, finance, management services, measurement/recognition/presentation of specific financial statement items - valuation services, impairment analysis, specialized knowledge, statistics, taxes, among other. Content is developed by Subject Matter Experts.

- No prerequisites or advanced preparation are required.

- Instructional Delivery Method: Group Live "In Person"; Group Internet Based "Online".

- Course Update Policy: Revision date is the date of the event.

- ASA's Refund and Cancellation Policy and ASA's Complaint Resolution Policy: https://www.appraisers.org/education/student-center/policies-procedures-and-FAQs

- A portion of net proceeds will be donated to 501(c)3 entities.

- Purchase of attendance ticket confirms your agreement to appear on livestream, should camera pan the audience. Thank you!

Tim Stuhlreyer ASA CPA/ABV

EVC EVENT CHAIR

Carol Akers Klug ASA MBA

EVC VICE CHAIR

ASA International Vice President

Appraiser of the Year - 2021

The Appraisal Foundation - Business Valuation Resource Panel

Laurie Leigh White ASA CEIV IA CPA

SPONSOR CHAIR

Appraiser of the Year - 2022

BV Discipline Vice Chair

Board of Examiners

James Herr ASA CFA CPA CEIV

BV SPEAKERS

jherr@alvarezandmarsal.com

Karl Bartholomew PE, ASA, MRICS

MTS & RENEWABLE SPEAKERS

karl.bartholomew@shell.com

Juliette B. Pearson, ASA Candidate, PE

BV SPEAKERS

info@jbpconsultingllc.com

Mike Hill FASA, CPA, ABV

BV SPEAKERS

Mike.Hill@Weaver.com

Atiba Henry ASA

BV SPEAKERS

ahenry@stout.com

Roger Grabowski, FASA

Leon Sleiman ASA Candidate

CPE & IT

leonabousleiman@gmail.com

EVC PANEL on INTANGIBLES

2025 EVC awarded ASA Chapter Education Event of the Year